Manufacturing is a capital-intensive sector. Being capital-intensive relates to the companies that are constantly facing huge capital expenditures.

To give an example, an Food processing manufacturing company would require heavy equipment for continuously producing products.

This makes such industries capital-intensive.

A manufacturing company incurs a variety of expenses. Right from purchasing inventory, investing in expensive machinery, procuring of products, providing other facilities, etc., fall under the category of “major expenditures.”

For such companies, one of the prominent business operations is “Financial Management”. Proper management of their finances is the crucial step toward maintaining their survival & growth.

And if not done properly then, companies overextend themselves— disrupting their cash flow pattern.

What is Financial Management? Challenges While Managing Manually!

Putting finances at the core is the success key for every business. The one who knows the skill of optimizing the working capital accomplishes the goal of reducing risks and increasing overall efficiency.

By definition, financial management is the process of managing a company’s finances in a way that it remains profitable & scalable in the present and in the future too.

This process, if performed manually, doesn’t prove to be sustainable and effective in this highly competitive and demanding scenario.

The laborious tasks of accumulating, compiling, validating, reconciling and processing financial data on spreadsheets occupy valuable time and resources.

Every manufacturer wants to focus more on strategic tasks instead of keeping most of the employees occupied eradicating cash flow challenges only.

But, performing mission-critical tasks manually such as managing Accounts Payable (AP), and Accounts Receivable (AR), tracking sales orders, maintaining an accurate general ledger, etc. all suck up time.

Also, the manual approach to accounting result in not just the inaccuracy in collecting and inputting data, but conceive data-integrity issues and thus, increase the chance of fraud.

Why Do Companies Need Finance ERP? The Value of Shifting from Manual to Automated

With the expansion of companies, their needs also change. At such times, improving the company’s financial performance becomes challenging for the business owners.

This proactively requires their accounting system to be capable enough of handling such intricate financial tasks efficiently.

So, it becomes clear to incorporate automated efficiencies to simplify the time-consuming and complex business processes. This makes companies benefit themselves from the finance module of a tailored software, ERP.

How does ERP Perform Financial Operations Efficiently?

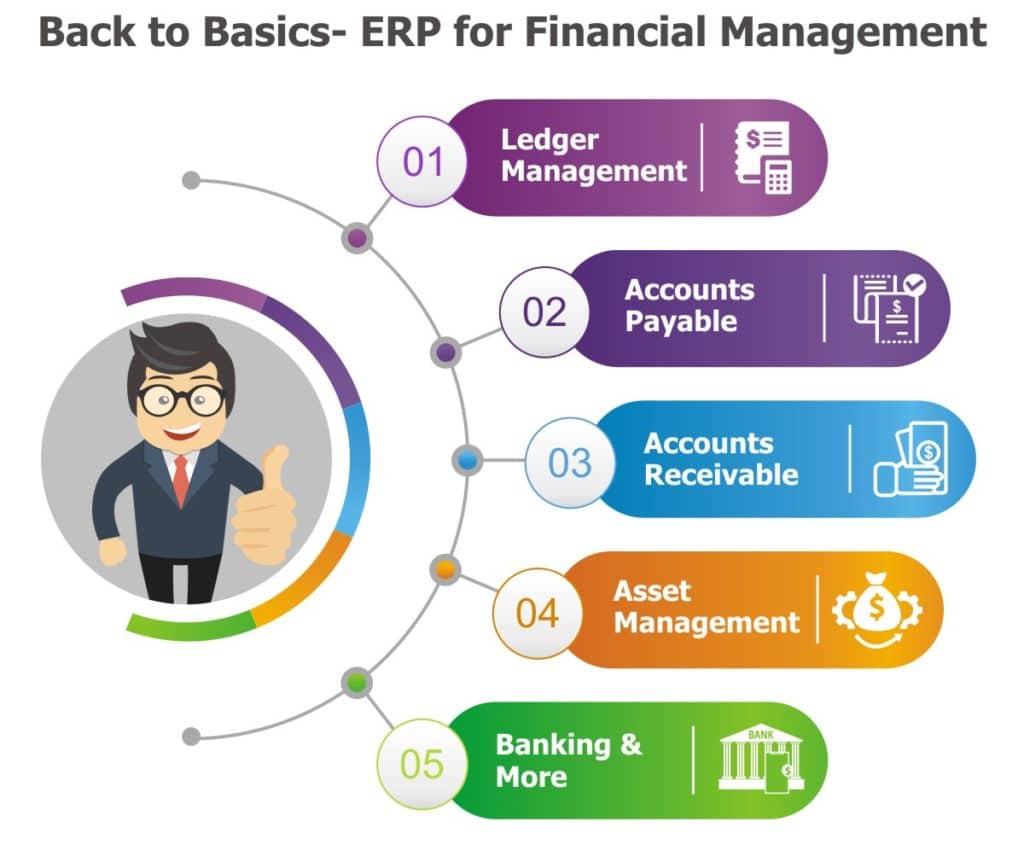

All-inclusive finance module of a multi-faceted ERP understand the business needs and syncs perfectly with all parts of the finance department, delivering a rich accounting experience. A few crucial capabilities are:

1. Ledger Management-

For a business, General Ledger (GL) is the fundamental accounting record that tracks all financial transactions of the organization including a chart of accounts, income statement, balance sheet, fixed assets, inventory, accounts receivable, accounts payable, etc. But, producing a detailed financial report (GL) demands financial data from all of the departments of a company.

An ERP perfectly connects the accounting department with all the other divisions of the company, allowing a seamless flow of financial data throughout the organization. This facilitates accurate information to make faster and more flawless ledgers.

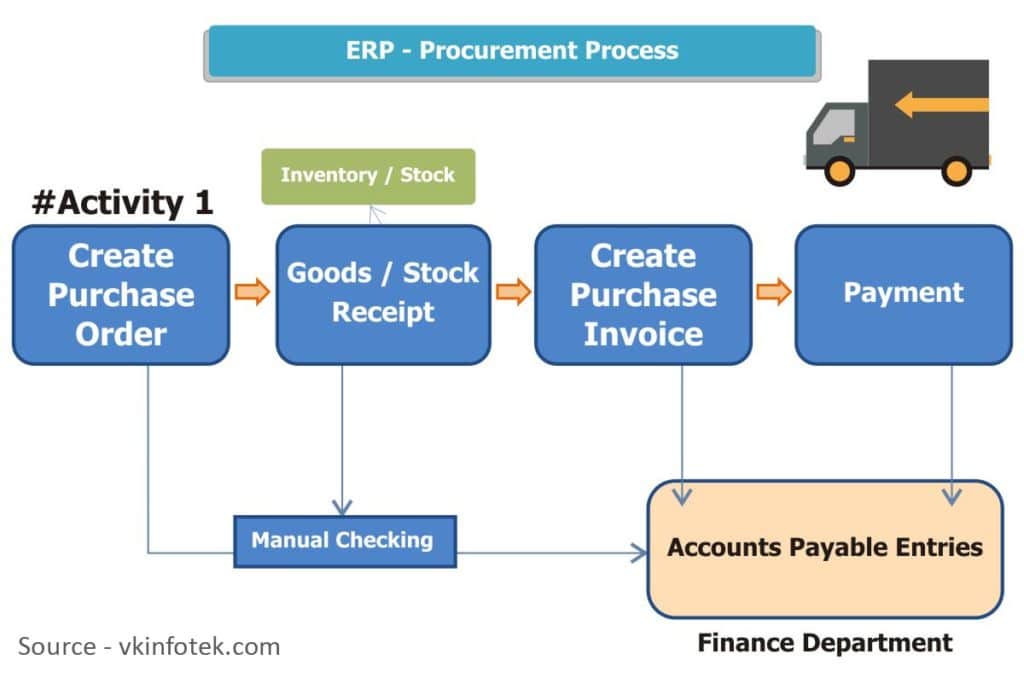

2. Accounts Payable-

This process refers to the money a manufacturer owes to its vendors and distributors for purchasing manufacturing supplies or other goods and services.

This whole process involves various labor-intensive tasks like creating and approving purchase orders (PO), placing an order with vendors, receipt of purchases made and invoices, and payment after approval of invoices.

The ERP system efficiently automates and streamlines all the tasks and eradicates issues like data entry errors, lost invoices, fraud, etc.

It also supports paperless processing, automatic reminders, and electronic payments— improving the overall efficiency of the organization.

3. Accounts Receivable-

This business function deals with the collection of money that customers owe to the company. This simple-sounding process involves ample opportunities for enhanced cash flow if managed properly.

For this reason, this functionality needs to be automated.

Instead of spending hours of effort entering data, a competent ERP easily automates and handles such laborious activities as recurring invoices, maintaining financial statements, maintaining terms, discounts, taxes, etc.

This way, companies can accelerate their collections— improve cash management, and reduce cash flow issues.

4. Asset Management-

Monitoring assets is of great importance to extend the lifecycle of tangible assets like manufacturing equipment, office space, computers, etc., and maximize the Return on Assets (ROA).

Organizations relying on ERP, successfully track the assets and gets better visibility in terms of utilization, costs, and maintenance of assets, to improve efficiency and optimize their functioning.

It also facilitates bigger savings by controlling financials like calculating depreciation costs, tax implications, etc.

Moreover, better insights into the assets’ life give the capability to predict equipment’s aging—helping you avoid costly breakdowns.

5. Other Operations- With an automated and continuous accounting approach of a proficient financial module of an ERP, organizations could easily execute many other arduous tasks such as:

- Performing account reconciliation to identify any misstatement or inaccuracy if present in the financial statements.

- Enabling WIP tracking to accurately manage costs of currently in progress jobs

- Giving full visibility on all transactions to access accurate information for precise financial reports.

- Allocating enterprise costs across multiple categories

- Automating tax calculations like TDS, GST, etc., to reduce the risk of errors.

Benefits of Financial/Accounting Modules of an ERP Software

With all the financial processes automated and integrated with other critical processes using finance ERP software, the benefits reaped are not just by the accountants and finance managers but by the organizations. Have a look:

- Single version of truth

- Provides financial transparency with better insights to produce detailed reports

- Provides financial stability by predicting, analyzing, and managing risks to the operations

- Keeps away fines and liabilities through tax reporting and audit functions

- Helps to forecast costs and revenue to produce more precise budget

- No cash crunch with transparency into cash flow

We are here to help-

If you are also looking for an ERP with financial capabilities, explore BatchMaster ERP that ensures the financial growth of the organization by efficiently managing all of the accounting practices.

Get in touch with our team of experts to know more or ask for a demo.